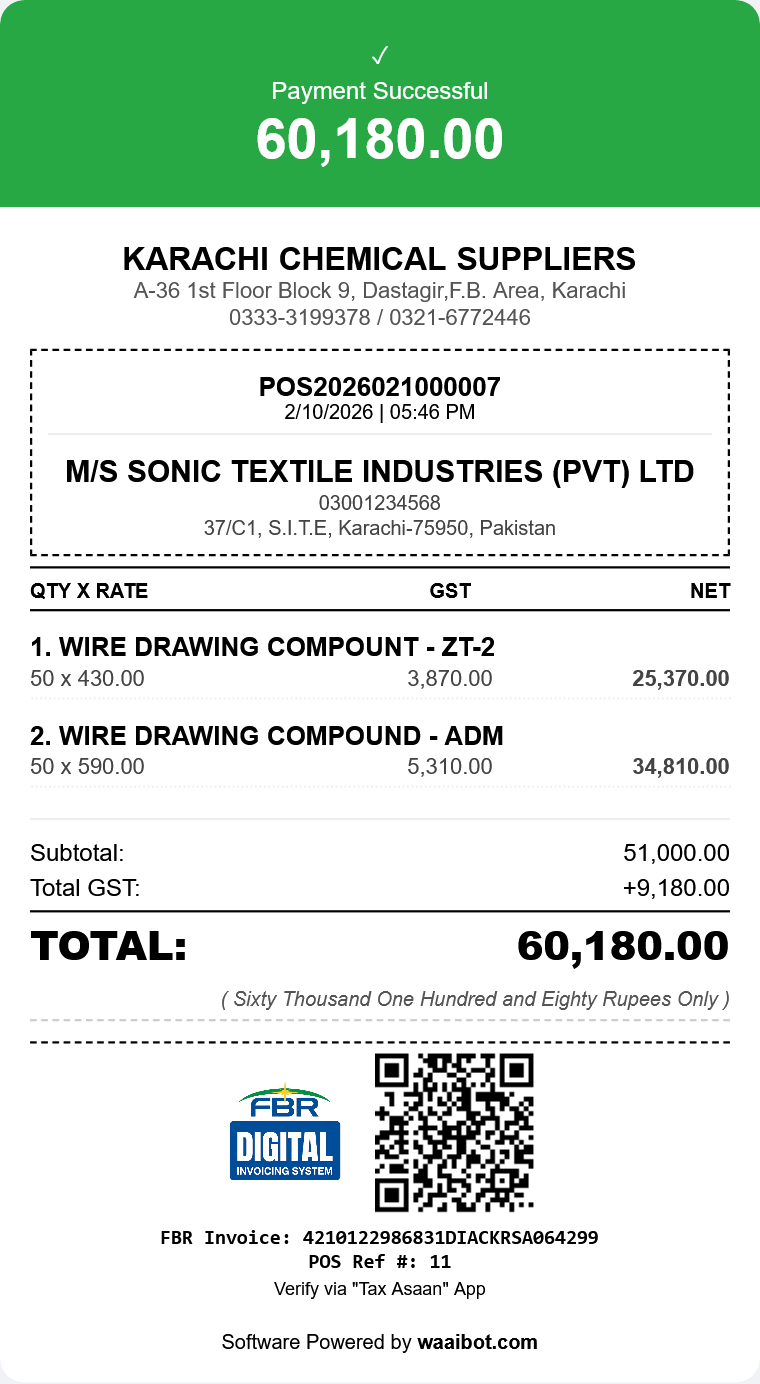

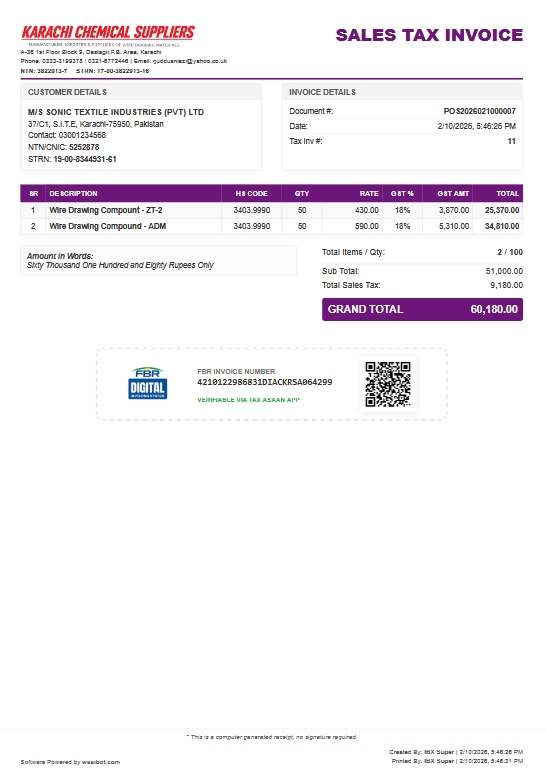

FBR Digital Invoicing &

POS Integration Software

"Pakistan ke tamam retailers aur wholesalers ke liye FBR compliant solution."

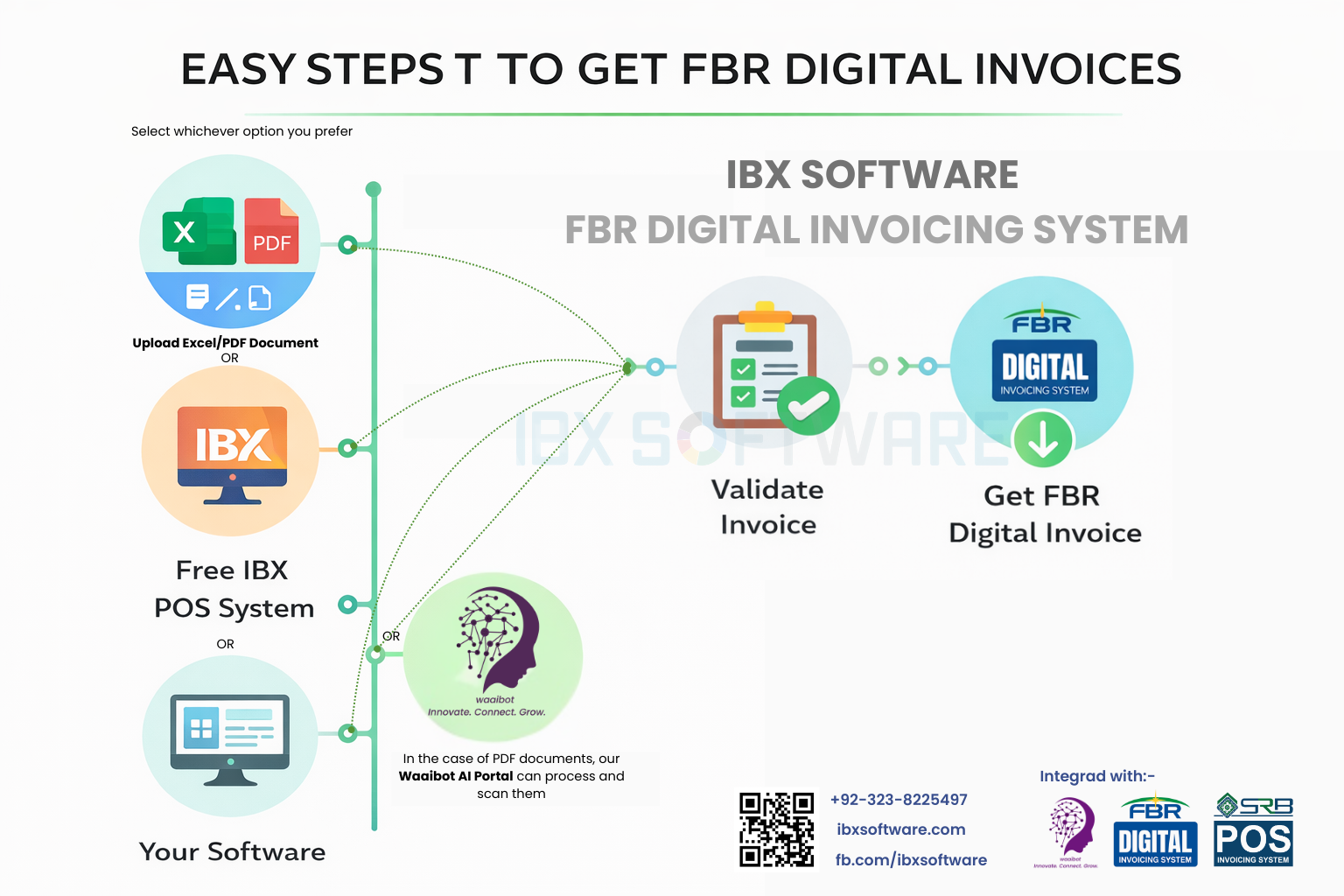

IBX enables real-time invoice reporting to FBR through licensed integrators. Get our Always Free POS with a simple one-time integration fee.